Cryptocurrency is a new generation of virtual or online money. It has become the most recent form of currency and is extensively recognized and accepted all over the globe. This is not in the same light as dollar or euro-type currencies that are centralized because it is not operated by a central authority like a government or a financial institution. On the other hand, it is done through a network of computers in a peer-to-peer manner, it is encrypted using cryptographic methods to make a transaction secure, a unit of currency is also created, as well as recording the transaction.

Equally, the whole aspect of the cryptocurrencies attributes has made it, sometimes a subject of controversy and at other times, hot in the financial world. As a beginner, at the end of this post, we will point out what cryptocurrencies are and how they can make your first steps in the digital world.

Table of Contents

- 1 Understanding Cryptocurrency: A Beginner’s Guide to Digital Currency & Blockchain

- 2 Blockchain Technology: The Backbone of Cryptocurrencies

- 3 How Crypto Works: Understanding Blockchain Technology, Proof of Work & Proof of Stake

- 4 Most Traded Cryptocurrencies: A Guide to Today’s Top Digital Coins

- 5 Purchasing and Protecting Cryptocurrency: Some Guidelines

- 6 Risks and Considerations

- 7 Conclusion

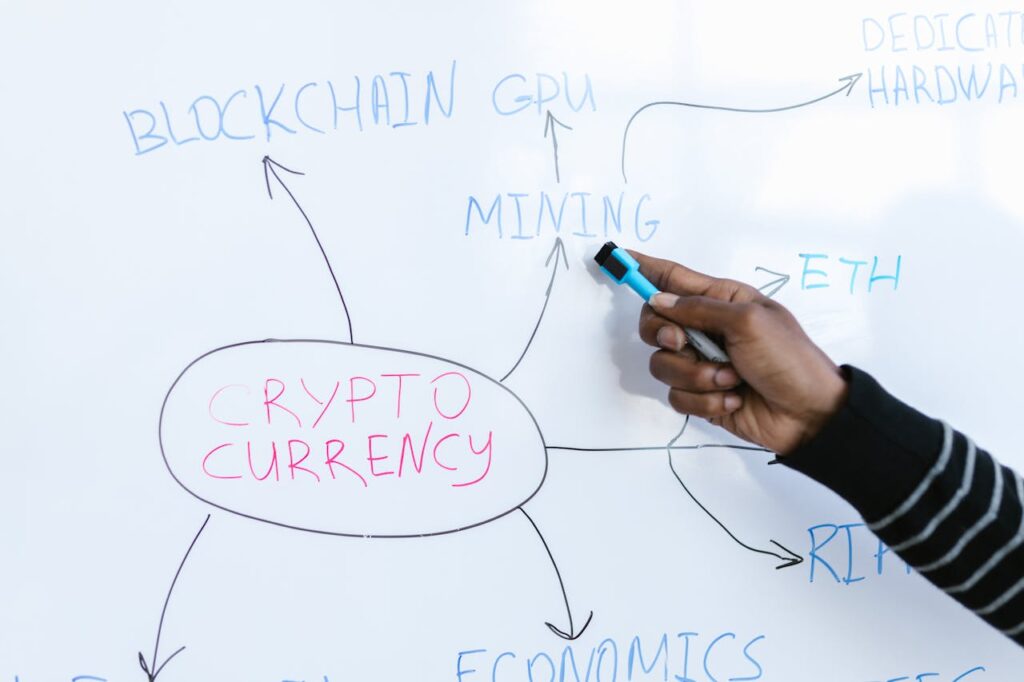

Understanding Cryptocurrency: A Beginner’s Guide to Digital Currency & Blockchain

Before we get to cryptocurrency, let’s break down the pieces of the puzzle: digital, decentralized, and cryptography.

- Digital: Unlike cash and coins, cryptocurrencies don’t exist as a physical form. They have the records of ownership and transactions stored as electronic records. Since it is digital, it’s easier to access and transfer on a computer, a cell phone, and on essentially any device.

- Decentralized: The new decentralized currencies differ from the traditional currencies issued and controlled by central banks. This means that neither the governments nor any financial institution has control of it.

- Cryptography: Successfully securing information using mathematical processes is called cryptography. Cryptocurrency uses cryptography, which allows cryptocurrency to track the creation of coins and therefore allow transactions with anonymity (the selfishness) or privacy in transactions, or proof of transferring an asset safely.

Blockchain Technology: The Backbone of Cryptocurrencies

The main technology behind cryptocurrencies is the blockchain. A blockchain is one distributed ledger, which records transactions through a computer network. A blockchain is made up of data blocks, each containing a list of transactions. This is because these blocks are linked in a historical order, which results in a “chain” of data, thus the name “blockchain.” Presenting blockchain’s decentralized nature, no central entity can ever change or even manipulate the transaction record. Since it is technically impossible to alter a block after it has been added to the chain, blockchain technology indeed gives a very secure and transparent way of keeping transaction records, and this feature of being unchangeable is one of the reasons why cryptocurrencies are safe and trustworthy.

How Crypto Works: Understanding Blockchain Technology, Proof of Work & Proof of Stake

The essence of cryptocurrency transfers is the P2P (peer-to-peer) networking. The transaction is sent to the network, where users called “miners” go through the process of confirming it. Miners carry out the confirmation, and hence they add the transaction to the blockchain through solving complicated mathematical equations by using the computers that are very powerful in the hash power. Then, this verification allows the transaction to be included in a newly created block. Subsequently, this block is joined to the existing blockchain. The mining process is powered that is used to make these verifications and solve math problems, thus using the computing power. Miners are rewarded for their work in the form of fees from transactions by consumers or the issuance of new cryptocurrencies such as Bitcoin.

Most Traded Cryptocurrencies: A Guide to Today’s Top Digital Coins

- Bitcoin: Bitcoin was a cryptocurrency created very first in human history. It is an asset which remains the most liquid and popular digital item today. It is the origin that is shrouded in mystery: since its creation, it is accredited to one person, or sometimes a group, called Satoshi Nakamoto in 2009. The whole idea was to create an alternative method, apart from the existing systems built around currencies, and which did not require a central authority in the form of banks or governments. After bitcoin was introduced, many releases of other cryptocurrencies followed, each with varying features and for various uses.

Let’s look at some of the most common choices today:

- Ethereum: Ethereum allows developers to build and deploy smart contracts-self-executing contracts where terms are coded into their decentralized platform. Ethereum, also referred to as ETH, is the native coin to pay for transactions and computational services on the network.

- Litecoin: generally referred to as “silver to bitcoin’s gold.” This is a peer-to-peer cryptocurrency. Very cheap, and transactions are faster when compared to more widely accepted Bitcoin. Litecoin was marketed by Charlie Lee in 2011. The concept is that it can perform speedier and successful transactions compared to Bitcoin.

- Ripple: This is a coin and a protocol for digital payments. The gist of the Ripple protocol is making international money transfers fast and inexpensive. On the Ripple network, transactions are made possible by the cryptographic currency used for the sake of the Ripple protocol, XRP.

- Cardano: Blockchain technology provides here a highly developer-friendly version of smart contracts and dApps on an even more scalable and safe base. There is a lot more, but this, for example, is much energy efficient than what Bitcoin’s function is that depends on a consensus mechanism of proof-of-stake.

And plenty more, but these are just a few. Each currency is for something, each user base, and even developer community.

Purchasing and Protecting Cryptocurrency: Some Guidelines

In a way, buying is the first step to interacting with the use. You can probably imagine innumerable ways to acquire Bitcoin, but it now appears that every conscience must favour opting for an exchange as one of the best avenues. An exchange for crypto is generally just an online market where the crypto currencies can be traded and exchanged for cryptocurrencies-who are the best-known ones: Binance, Gemini, Kraken, and Coinbase, to name a few. Well, after picking up the cryptocurrency, hold it with care. Even if the crypto is being held in an exchange, it is better to send it to an individual wallet. Wallets are two types of applications and devices.

- Hot Wallets: A wallet of some sort exists through software, making it available on the internet for use. Although not as safe as cold wallets, hot wallets are great for those who want to make just one transaction over a short span of time.

- Cold Wallets: Cold wallet refers to hardware or offline storage media not use the internet. It is the perfect solution to hold crypto for the long term. This equips it with far better security.

Risks and Considerations

The cryptocurrency has its advantages, but it also comes with several risks, some of the main ones being:

- Volatility: As price volatility can be quite enormous, cryptocurrencies can presumably be hazardous wagers for the unsuspecting investor. Many cryptocurrency traders have received enormous returns, a vast majority, however, have lost money in the price crashes.

- Regulatory Uncertainty: Regulation of cryptocurrencies is still a work in progress in most countries worldwide. The existence of a few countries that outrightly ban cryptocurrencies, while others regulate them strictly, creates a shadow of uncertainty in the minds of end-users and investors.

- Security: Although the blockchain technology is secure, Bitcoins can be hacked from the wallets and exchanges. You must defend yourself using passwords, activating two-factor authentication, and keeping your money in a safe wallet.

Conclusion

Cryptocurrency is a highly dynamic and complicated field which offers the potential to transform the financial sector entirely. Cryptocurrencies provide something that cannot be provided by any other form of conventional currency – decentralized digital assets protected through cryptography. Its underlying technology, the blockchain, is by far the most exciting of all its applications; nevertheless, some dangers should be kept in mind. It is very important that a newbie learns and keeps themselves updated with the new market developments and safeguards their investment by taking adequate precautions. Cryptocurrencies present one highly exciting new frontier in the digital economy – be it for investment, commercial usage, or merely to have a better idea of the technology behind it.